Written by Yanis Kharchafi

Written by Yanis KharchafiHow to understand your salary certificate perfectly?

Introduction

Dear readers, in this new article we are going to look at a document that may not be captivating, but is so crucial for all employees working for a company based in Switzerland, whether you are a cross-border commuter or a Swiss resident.

This document is the salary certificate. This is the single document summarising all the income received and other information directly related to your employment with the same company. Multiple jobs mean multiple salary certificates.

This document is quite simply the starting point for your tax returns, so it’s important to understand it and, above all, to avoid making mistakes on your tax returns.

The line-up:

What is a salary certificate?

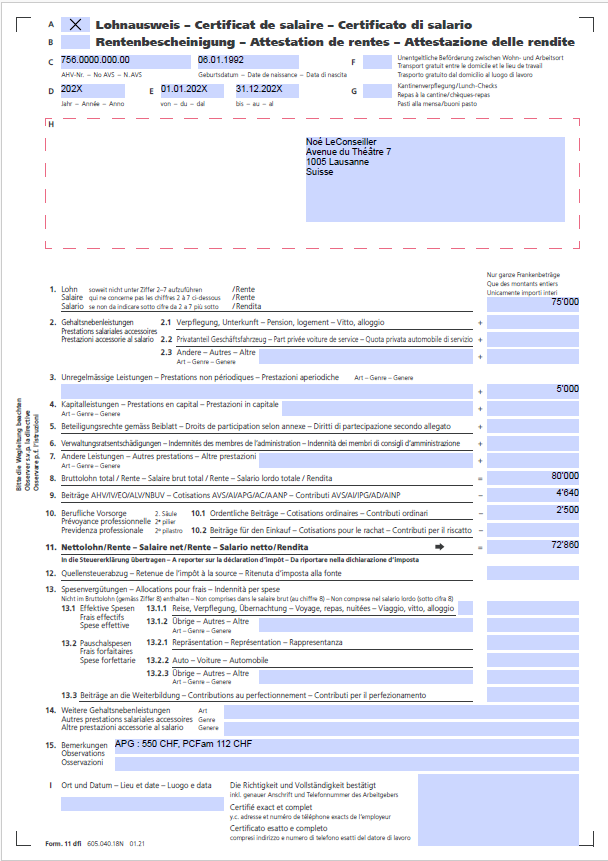

To make things easier for you, we’ve created a fictitious certificate in the name of our mascot Noé LeConseiller.

No matter where you live in Switzerland, whether it’s towards us in French-speaking Switzerland or towards Germany or Italy, the salary certificate always has the same format. The only slight oddity you may notice is the colour: sometimes black and white, sometimes pink, and in rarer cases, it may turn orange.

Enough about colour details, the salary certificate contains all your payslips. It provides a precise and useful summary for a variety of purposes:

- The tax return

- Buying a property

- Obtaining a loan

In addition to the income and social security contributions paid, the salary certificate can provide the tax authorities with discreet information about your employer’s generosity. Does it provide a cafeteria or lunch facilities? Does it contribute in any way to your transport costs?

Finally, the salary certificate provides useful information about your tax rights, such as tax return deadlines, the tax scales used, teleworking days granted and your place of work.

Now let’s look in more detail at the different parts of your salary certificate.

What information does a salary certificate contain, from letter A to H and number 1 to 15?

From A to H: Essential information without figures

Letters A and B

The document used to create a salary certificate can also be used to certify potential pensions that could have been paid to you during the year, such as AVS and LPP retirement pensions. An official pension is similar to a salary: it represents an obligation to pay a certain sum each year. In this article, we will concentrate on the salary part. The letter A therefore indicates that the certificate is in fact a salary, while the letter B indicates that it is a pension.

Letters C to E

The letters C, D and E are used to identify the owner of the salary certificate. The letter C corresponds to your AVS number and your date of birth, the letter D indicates the year of the certificate, and the letter E specifies the period of the year during which the certificate was valid. Although it is usual to work from 1 January to 31 December in the same company, changes of job, moves or career breaks can occur at any time of the year.

Letter F: free transport

If this box is ticked, it means that your employer contributes to your commuting costs. For example, it may finance your public transport season ticket. The consequence is that the cantons offer a deduction for transport costs, which will probably be refused if this box is ticked. As a result, you will not be able to deduct the cost of travelling to work.

If you would like to find out more about the deductions authorised by your canton of residence, here are a few useful links:

- Authorised tax deductions for the canton of Vaud

- Authorised tax deductions for the canton of Geneva

- Authorised tax deductions for the canton of Valais

Letter G: meal expenses

In a similar way to transport, letter G relates to meal expenses. If your employer provides a canteen offering reduced-price meals or finances your lunches in some other way, you will not be able to claim a deduction for meal expenses when you file your tax return.

These letters, from A to G, represent essential, non-calculated information that helps to clarify the employee’s financial and professional situation for a given year.

Letter H: other personal information

The letter H is easy to understand: it contains your personal details such as your surname, first name and address. These details clearly identify the holder of the salary certificate.

Letter I: place, date and signature

In this section, you will find information about the company that issued the salary certificate, as well as the name of the person within the company who drew it up. This section also includes the date on which the certificate was issued, attesting to its validity and official status.

From point 1 to point 15: Quantitative information

In this second section, we move on from qualitative to quantitative information. This is where you can find out exactly what you have earned and paid for your business.

Point 1: your salary

This first line covers mainly the fixed salary paid by your employer throughout the year. It also includes certain allowances paid directly by the employer, commission and, in very specific cases, certain payments made to you by your employer as a result of insurance compensation.

Point 2: your additional services

In some companies or trades, your employer may provide you with ‘income in kind’, such as a company car (which is quite nice), finance part of your accommodation or contribute to your health insurance payments. As this income is entered at the top of your salary certificate (before the figure 11), it forms an integral part of your taxable income and, consequently, even if your employer has paid these expenses, the resulting deductions will still be allowed.

Point 3: non-periodic salary benefits or, more simply, your bonuses

If the company you work for has had a good year (potentially thanks to you) or if you have particularly exceeded your targets, it is not uncommon to be awarded a bonus, and it is in this section that it will be indicated.

Point 4: Capital benefits

To be honest, it’s not very common to have figures entered in this section of the salary certificate, but in rare cases your employer may pay severance pay for pension purposes (2nd pillar), other severance payments directly linked to your retirement or even deferred salaries.

Point 5: Your participation rights

Quite rare in small businesses but common in larger companies, “shares in your company” can be offered to motivate you to contribute to its growth. The better your work, the higher the value of these shares could rise, encouraging you to give your best. These shares are generally blocked for a period before they can be sold. The number 5 indicates the value of these shares, which is considered to be taxable income for the year in question. In addition, an appendix to your salary certificate is usually provided detailing the number of shares, the type of share and the amounts to be reported on your tax return.

Tip: In theory, given that the gross salary already includes the income from your new employee shares, it would not be necessary to provide any further information. However, we recommend that you mention the number of blocked shares in the securities section of your tax return, indicating taxable assets of CHF 0 and adding a note “PM” (for the record). This practice makes it easier to explain changes in assets when the shares are sold, so that changes from one year to the next can be clearly traced.

Point 6: Board member compensation

Similar to number 4, these headings are rarer, concern only a small number of clients and should only be completed when you have been remunerated for your services as a member of a company board of directors in order to value the time you have given them.

Point 7: Other services

This heading covers all other income not mentioned above, such as tips or certain unemployment benefits.

Point 8 : Gross salary

Along with the net salary (figure 11), this is undoubtedly the most important figure on your salary certificate. It is this figure that gives you the gross amount you would actually have received during that year from that employer. The gross salary forms the basis of your tax burden. There are still many steps to be taken to go from a gross salary to a taxable salary, but this is the first step.

Point 9: AVS/AI/APG contributions

For those who are not familiar with it, the AVS is the basis for retirement and, more generally, for social security in Switzerland. The amount shown on line 9 of your salary certificate details the share of contributions for the first pillar (risk and savings) that has been deducted by your employer directly from your gross salary. These deductions are used to finance part of the overall contributions. For 2024, total contributions to the first pillar amount to 10.6% of gross salary, divided equally between employer and employee, i.e. 5.4% each. This information is clearly indicated in this section of the certificate.

Point 10: Ordinary 2nd pillar contributions (LPP)

Point 10 of your salary certificate, and more specifically point 10.1, represents the portion of your salary that has been deducted to finance the second pillar of the Swiss pension system, the occupational pension scheme (BVG). As with the first pillar (AVS, shown in figure 9), employers generally contribute half of the annual contribution, while the other half is deducted from employees’ wages and detailed under this heading. It is important to note that employers have the option of deducting nothing from your salary and paying all, or at least more than half, of these contributions.

Section 10.2 of your salary certificate will rarely be filled in, as it concerns any LPP/BVG buy-backs you may have made during the year. In practice, if you do make purchases, you will receive a separate tax certificate specifying the amount of contributions purchased, but this information will not appear on your salary certificate. An important piece of advice: if you buy back years, don’t base your calculations solely on this line. Make sure you ask for your certificate and, above all, don’t forget to declare the buy-back correctly on your tax return.

Point 11: Net salary

After the gross salary (figure 8), the net salary is one of the most important figures on the salary certificate. Unlike the gross salary, the net salary represents the amount actually received by the employee for the current year, and it is this amount that will be used to calculate your tax. Net pay is simply gross pay less pension contributions.

Point 12: Tax deducted at source

For people who do not have a C permit or Swiss nationality, employers are required to deduct an amount of tax from their gross salary depending on their family situation (single, married, with dependent children) in accordance with the applicable scale. People who are taxed at source will therefore receive their net salary after deduction of the tax withheld in their bank account. It is important to note that paying tax at source does not guarantee that the final tax is correct. In some cases, it is compulsory to submit a tax return, and for other taxpayers without this obligation, it may nevertheless be worthwhile doing so for tax purposes.

Point 13 & 14: Cost allowances

For some employees and certain positions, it is necessary to incur significant expenses to carry out the tasks required, such as business travel, restaurant meals or expenses incurred at the customer’s premises. These costs can be reimbursed directly to the employee to cover all these expenses, without these amounts being considered as taxable income. You will therefore receive a reimbursement net of tax. However, it is important to note that if you receive this type of allowance, certain deductions for business expenses may be disallowed when you file your tax return.

Point 15: Observations

The section indicated by number 15 is used to provide any additional information that does not fit into the other sections of the salary certificate. Here you can find details such as the deadlines for filing tax returns, the scales used to calculate withholding tax, and details of other types of insurance financed by the employer from the employee’s salary, such as insurance for loss of earnings, PCFam, etc. This section also informs the authorities about the employee’s activity rate, place of work and the possibility of teleworking.

What information should I transfer from my salary certificate to my tax return?

The salary certificate is an essential document for the tax return of all employees. Once you have filled in your personal details and your family situation, this certificate becomes the first tool you need to make progress with your tax return. The usefulness of the information varies from canton to canton.

Gross or net salary

In some cantons, such as Vaud, you do not need to enter lines 1 to 10; you just enter the net salary, i.e. number 11. You may optionally mention 2nd pillar contributions, but only the amount of the salary is taken into account. In the canton of Geneva, on the other hand, taxpayers have to itemise each line to arrive at the net salary.

Contributions to meal and transport costs

Most cantons require you to specify manually whether boxes G or F are ticked, so that they can adjust the deductions you claim later under business expenses. If these boxes are ticked, the tax authorities will check that you have not claimed deductions that, in theory, are not due to you.

Comments on point 15

Few taxpayers know this, but in some cantons such as Vaud, insurance covering loss of earnings, which is paid out, can be deducted from your net salary. For example, you can deduct loss-of-earnings insurance directly in figure 15 of VaudTax, whereas in the canton of Geneva, this deduction must be reported under health and accident insurance.

So, after carefully examining each line of your salary certificate, it turns out that there is very little information to report on your tax return. Is that disappointing? Perhaps, but at least you now have a better understanding of your salary certificate, which is already a big step forward.

What is the difference between a salary certificate and a payslip?

In a previous article, we went into detail about payslips, their appearance and their uses. However, here we will focus on the differences between payslips and salary certificates. Salary slips are monthly documents distributed to all employees. They enable you to keep track, from one month to the next, of the salary paid, the contributions paid and what will soon be deposited in your bank account. In a way, they are a salary certificate, but on a monthly basis.

The main difference is that payslips are more personal and internal documents, with less legal and tax significance than the salary certificate, which has to be submitted to the various authorities. Nevertheless, payslips can be extremely useful in practical situations such as finding accommodation or showing a bank that your income has recently increased.

Where can I find my salary certificate?

The way in which you access your employment-related documents can vary considerably depending on the size and modernisation of your company. In recent years, as digitalisation has progressed, it is not uncommon for large companies to offer their employees access via a digital interface where they can consult important documents such as the BVG certificate, salary certificate, payslips, employment contract, etc. For employees of small companies like ours, the employer is generally required to send salary certificates by post or email.

What do I do if I can’t find my pay slip?

If you think you have not received your salary certificate or have mislaid it, you can always contact your employer to request a copy. As a general rule, employers are required to keep a copy of all their employees’ certificates, ensuring that you can retrieve the necessary documents at any time.

When can I expect to receive my salary certificate?

A salary certificate cannot be issued before the end of the tax year or before the end of your tax liability period in Switzerland. Given the importance of this document for your tax return, employers must wait until the end of the year to collect all the necessary data. They must then act quickly to issue these certificates by the required deadline. Salary certificates are therefore usually distributed between the beginning of January and March of the following year. However, some companies may be late in issuing this document. If this is the case, it is important to ask the tax authorities for an extension to comply with the legal deadlines.

What should I do if I make a mistake on my salary certificate?

We are fully aware that detecting an error in a salary certificate is not an easy task, even for experts. The amounts shown on the certificate summarise all the items paid for the year, and without full knowledge of all the details of the payments made by the employer, it is almost impossible to identify any input errors. However, some amounts, such as gross salary, BVG contributions and withholding tax, may be clearly out of line and therefore easier to spot. If in doubt, we strongly recommend that you contact your company’s human resources department to ask any relevant questions and clear up any uncertainties.

Some reliable external resources to help you understand your salary certificate

In this section, we provide you with a list of legal and reliable sources of information. These resources will help you gain a deeper understanding of the salary certificate.

- Guide to drawing up the Confederation’s salary certificate

- Guide to AVS social security contributions

How can FBKConseils help you with your salary certificate?

After carefully reading our explanations, it is clear that FBKConseils cannot intervene directly to resolve problems with your salary certificate; you will have to contact your employer to make the necessary corrections. However, FBKConseils can offer you valuable support.

Understanding your salary certificate

FBKConseils can help you better understand your salary certificate, assist you in detecting any inaccuracies, and give you a clearer picture of what you actually earn and what you pay in contributions and tax.

Support with the tax return process

We can support you throughout the tax return process, providing advice tailored to your tax situation and helping you to optimise your return to take advantage of all possible tax benefits.